Exactly How Animals Threat Security (LRP) Insurance Can Protect Your Animals Financial Investment

In the world of livestock financial investments, mitigating threats is extremely important to ensuring financial stability and development. Animals Risk Security (LRP) insurance coverage stands as a trusted shield versus the uncertain nature of the marketplace, providing a critical strategy to guarding your properties. By delving into the intricacies of LRP insurance and its multifaceted advantages, animals producers can fortify their financial investments with a layer of security that goes beyond market changes. As we explore the realm of LRP insurance, its role in securing livestock financial investments ends up being increasingly noticeable, guaranteeing a path in the direction of lasting financial strength in an unstable sector.

Understanding Livestock Threat Protection (LRP) Insurance Policy

Understanding Livestock Threat Security (LRP) Insurance coverage is important for livestock manufacturers seeking to reduce financial threats related to cost fluctuations. LRP is a government subsidized insurance coverage product made to safeguard producers against a decrease in market value. By offering insurance coverage for market value decreases, LRP assists manufacturers secure in a floor rate for their livestock, making sure a minimum degree of income no matter market fluctuations.

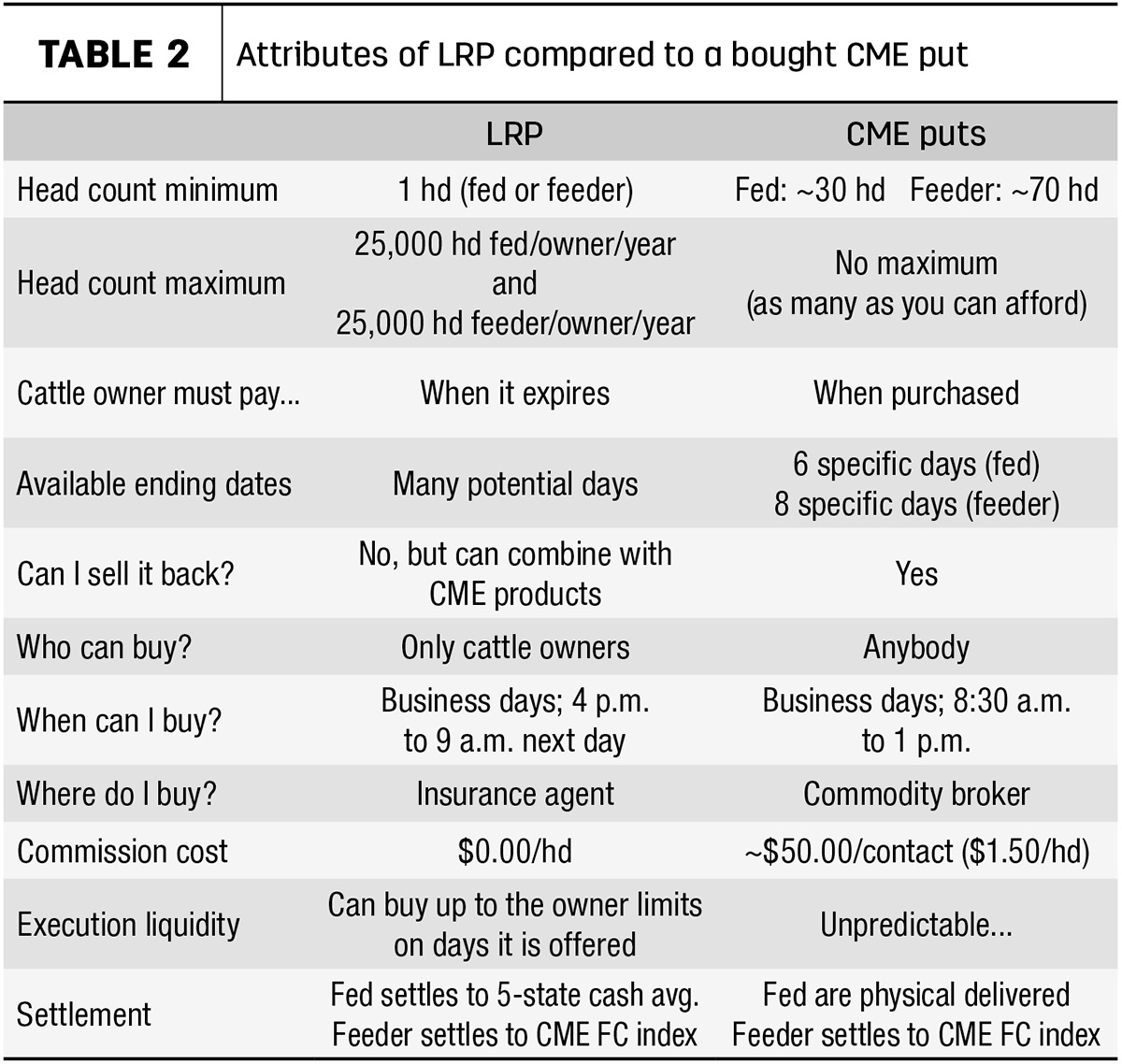

One trick element of LRP is its flexibility, permitting producers to personalize coverage degrees and plan lengths to fit their specific requirements. Manufacturers can choose the number of head, weight array, coverage cost, and insurance coverage period that line up with their manufacturing objectives and take the chance of tolerance. Comprehending these personalized options is crucial for producers to properly handle their price danger direct exposure.

Furthermore, LRP is readily available for various animals kinds, including livestock, swine, and lamb, making it a functional threat monitoring tool for livestock manufacturers throughout various industries. Bagley Risk Management. By acquainting themselves with the complexities of LRP, producers can make informed choices to protect their financial investments and guarantee monetary stability when faced with market unpredictabilities

Advantages of LRP Insurance Policy for Livestock Producers

Animals manufacturers leveraging Livestock Risk Defense (LRP) Insurance coverage obtain a critical advantage in shielding their financial investments from price volatility and safeguarding a steady monetary ground amidst market uncertainties. One essential advantage of LRP Insurance policy is price protection. By setting a flooring on the rate of their livestock, producers can mitigate the danger of significant economic losses in the occasion of market downturns. This permits them to plan their budget plans a lot more properly and make educated decisions about their procedures without the continuous worry of rate fluctuations.

Moreover, LRP Insurance provides manufacturers with comfort. Knowing that their investments are guarded against unexpected market adjustments permits producers to focus on other elements of their business, such as improving animal wellness and welfare or enhancing production processes. This peace of mind can lead to enhanced performance and success in the future, as producers can run with more self-confidence and stability. On the whole, the benefits of LRP Insurance policy for animals producers are considerable, providing a useful tool for taking care of risk and guaranteeing financial protection in an unpredictable market setting.

Exactly How LRP Insurance Coverage Mitigates Market Risks

Reducing market risks, Animals Danger Protection (LRP) Insurance provides livestock producers with a reliable guard against rate volatility and monetary uncertainties. By offering security against unanticipated price declines, LRP Insurance policy assists producers protect their investments and preserve financial security despite market changes. This kind of insurance policy enables animals producers to lock in a rate for their animals at the start of the policy duration, guaranteeing a minimal cost level no matter market adjustments.

Actions to Secure Your Livestock Financial Investment With LRP

In the realm of agricultural risk administration, implementing Animals Danger Security (LRP) Insurance coverage includes a tactical process to protect investments against market variations and uncertainties. To protect your animals financial investment effectively with LRP, the first action is to examine the details dangers your operation deals with, such as price volatility or unexpected climate events. Recognizing these dangers read enables you to identify the coverage degree needed to protect your investment appropriately. Next off, it is vital to research study and select a respectable insurance coverage company that provides LRP policies customized to your livestock and organization requirements. Once you have chosen a copyright, very carefully evaluate the policy terms, problems, and coverage restrictions to guarantee they line up with your risk administration goals. In addition, consistently keeping an eye on market fads and changing your insurance coverage as needed can aid optimize your security versus potential losses. By complying with these actions faithfully, you can improve the protection of your livestock investment and browse market unpredictabilities with confidence.

Long-Term Financial Security With LRP Insurance

Ensuring enduring economic security via the application of Animals Danger Security (LRP) Insurance coverage is a prudent lasting strategy for farming manufacturers. By integrating LRP Insurance coverage into their risk administration plans, farmers can guard their animals investments against unforeseen market variations and unfavorable events that could jeopardize their economic wellness in time.

One key advantage of LRP Insurance for long-term economic safety is the assurance it offers. With a reliable insurance plan in position, farmers can reduce the monetary risks connected with unstable market conditions and unforeseen losses due to factors such as condition outbreaks or all-natural catastrophes - Bagley Risk Management. This security enables manufacturers to concentrate on the daily procedures of their livestock business without continuous worry regarding possible economic obstacles

Furthermore, LRP Insurance policy provides an organized method to managing danger over the long term. By setting details protection degrees and choosing suitable recommendation periods, farmers can customize their insurance policy prepares to straighten with their financial goals and run the risk of resistance, making sure a secure and sustainable future for their animals procedures. Finally, spending in LRP Insurance policy is a proactive method for farming manufacturers to achieve long i loved this lasting economic security and safeguard their source of incomes.

Verdict

In final thought, Livestock Risk Protection (LRP) Insurance is a valuable tool for livestock producers to minimize market threats and protect their investments. It is a wise selection for guarding animals investments.